In the rapidly evolving financial landscape, businesses are increasingly leveraging AI-powered accounting platform development to streamline operations, enhance accuracy, and drive efficiency. Traditional accounting methods, often prone to human error and time-intensive processes, are being replaced by intelligent automation solutions that revolutionize how financial data is managed, analyzed, and reported. With AI-driven platforms, companies can automate bookkeeping, optimize tax compliance, and gain real-time financial insights, empowering them to make data-driven decisions with greater confidence.

As artificial intelligence continues to reshape industries, accounting is no exception. AI-powered accounting solutions integrate machine learning (ML), natural language processing (NLP), and predictive analytics to automate complex tasks such as invoice processing, fraud detection, financial forecasting, and audit management. These platforms eliminate manual data entry, reducing errors and enhancing efficiency while ensuring compliance with regulatory standards. Moreover, AI-driven financial tools offer proactive insights into cash flow management, expense tracking, and revenue forecasting, helping businesses stay ahead in an increasingly competitive market.

Beyond automation, AI-powered accounting platforms bring scalability and adaptability to businesses of all sizes. Whether it’s a small startup looking to optimize financial workflows or a large enterprise managing intricate accounting structures, AI-driven solutions offer customizable features that align with diverse financial needs. With cloud integration, real-time analytics, and advanced security protocols, businesses can ensure data protection while benefiting from seamless, automated financial operations.

In this comprehensive guide, we will explore the key components, benefits, and development process of AI-powered accounting platforms. From understanding the role of AI in financial management to implementing robust AI-driven solutions, this blog will provide valuable insights into how businesses can harness AI technology to revolutionize their accounting systems. Let’s dive into the future of accounting and uncover the transformative potential of AI-powered financial solutions.

The Importance of Automation and Real-time Insights in Accounting

In today’s fast-paced financial environment, automation and real-time insights have become fundamental to modern accounting. Businesses require accuracy, efficiency, and agility in their financial processes to maintain compliance, optimize operations, and make strategic decisions. Traditional accounting methods, which often rely on manual data entry and delayed reporting, can lead to inefficiencies, errors, and missed opportunities. The integration of automation and real-time analytics addresses these challenges by enhancing precision, streamlining workflows, and providing timely financial intelligence.

Automation in accounting reduces the dependency on repetitive manual tasks, ensuring that financial data is processed swiftly and accurately. By eliminating human intervention in routine processes, organizations can enhance productivity, minimize risks, and allocate resources more effectively. Automated systems also ensure consistency in financial records, helping maintain compliance with regulatory standards and internal controls. Furthermore, automation fosters scalability, allowing businesses to handle increasing financial complexities without proportional increases in workload.

Real-time insights empower decision-makers with up-to-the-minute financial data, enabling proactive management of financial health. Immediate access to financial trends, cash flow patterns, and performance metrics allows businesses to adjust strategies dynamically, mitigate potential risks, and seize growth opportunities. In an era where agility is crucial, real-time financial monitoring ensures that organizations remain competitive and responsive to changing market conditions.

By integrating automation and real-time insights into accounting, businesses can achieve operational excellence, enhance financial transparency, and drive sustainable growth. The ability to automate processes and access real-time data transforms accounting from a reactive function into a strategic asset, paving the way for more informed and confident decision-making.

What is AI-powered Accounting?

AI-powered accounting refers to the integration of artificial intelligence (AI) technologies into financial management and bookkeeping processes to enhance efficiency, accuracy, and decision-making. By leveraging machine learning (ML), natural language processing (NLP), and predictive analytics, AI-driven accounting systems automate routine tasks, analyze complex financial data, and provide real-time insights to businesses and financial professionals.

Unlike traditional accounting methods that rely heavily on manual data entry and rule-based automation, AI-powered accounting solutions continuously learn from financial transactions, identify patterns, and improve their accuracy over time. These systems can process large volumes of data at high speeds, reducing human errors and optimizing financial workflows. AI-driven platforms also enable proactive financial management by detecting anomalies, forecasting trends, and ensuring compliance with regulatory requirements.

The key components of AI-powered accounting include automated bookkeeping, intelligent invoice processing, fraud detection, tax optimization, and real-time financial reporting. By automating these tasks, AI enhances productivity and allows accountants and finance teams to focus on strategic decision-making rather than time-consuming administrative work.

As businesses increasingly embrace digital transformation, AI-powered accounting is becoming a game-changer in financial management. It not only streamlines operations but also empowers organizations with actionable insights, helping them make informed financial decisions and adapt to changing market dynamics with greater agility.

How AI is Used in Modern Accounting Software?

AI has become a transformative force in modern accounting software, revolutionizing financial management by enhancing automation, accuracy, and decision-making capabilities. By integrating machine learning (ML), natural language processing (NLP), and predictive analytics, AI-driven accounting platforms streamline operations and provide businesses with actionable financial insights.

- Automated Bookkeeping & Data Entry: AI-powered accounting software eliminates the need for manual data entry by automatically categorizing transactions, reconciling accounts, and recording financial data with precision. By leveraging ML algorithms, the system continuously learns from past entries to improve classification accuracy and detect anomalies.

- Intelligent Invoice & Expense Processing: Modern AI-driven platforms extract relevant details from invoices and receipts using optical character recognition (OCR) and NLP. These systems can match invoices with purchase orders, detect discrepancies, and automate approvals, reducing processing time and minimizing human intervention.

- Fraud Detection & Risk Management: AI enhances security by monitoring financial transactions for suspicious activities and anomalies. By analyzing patterns and historical data, AI-powered fraud detection systems can identify irregularities in financial behavior, helping businesses mitigate risks and comply with regulatory requirements.

- Predictive Financial Analytics: With AI-driven predictive analytics, businesses gain insights into cash flow trends, revenue projections, and financial performance. By analyzing historical data, AI forecasts future financial scenarios, allowing organizations to plan budgets, optimize expenditures, and make data-driven strategic decisions.

- Tax Compliance & Regulatory Reporting: AI streamlines tax compliance by automatically tracking tax obligations, applying relevant tax laws, and generating accurate reports. It ensures that businesses adhere to changing tax regulations while minimizing errors and penalties associated with non-compliance.

- Chatbots & Virtual Assistants: AI-powered chatbots assist accountants and finance teams by answering queries, generating reports, and providing real-time financial insights. These virtual assistants improve workflow efficiency and reduce the time spent on administrative tasks.

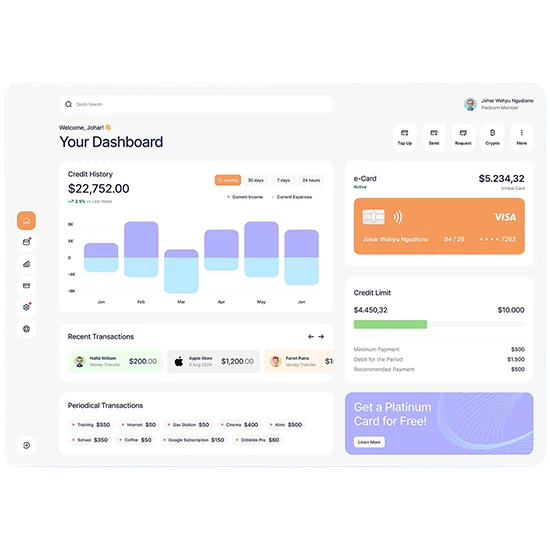

- Real-Time Financial Reporting & Insights: AI-driven accounting software provides real-time dashboards that display key financial metrics, enabling businesses to monitor performance and make quick, informed decisions. These insights help organizations stay agile in response to market fluctuations.

Why Do Businesses Need AI in Accounting?

In the digital era, businesses are increasingly adopting AI in accounting to enhance efficiency, accuracy, and strategic decision-making. Traditional accounting processes often involve manual tasks, data inconsistencies, and time-consuming financial management. AI-driven solutions address these challenges by automating workflows, reducing errors, and providing real-time financial insights.

- Automation of Repetitive Tasks: AI eliminates the need for manual data entry, invoice processing, and transaction categorization. By automating these routine accounting tasks, businesses can free up valuable time and allow finance teams to focus on higher-value activities like financial planning and strategy.

- Increased Accuracy & Error Reduction: Human errors in accounting can lead to financial discrepancies, regulatory issues, and compliance risks. AI-powered systems analyze financial data with precision, ensuring that records are accurate and consistent while minimizing the likelihood of mistakes.

- Real-Time Financial Insights: AI enables businesses to access real-time financial reports, dashboards, and analytics, allowing decision-makers to monitor cash flow, expenses, and revenue at any moment. This immediate access to financial health insights helps businesses make proactive decisions.

- Enhanced Fraud Detection & Security: AI algorithms can detect anomalies, suspicious transactions, and fraudulent activities by analyzing historical financial patterns. Businesses can mitigate risks, improve compliance, and enhance financial security through AI-driven fraud detection.

- Cost Savings & Efficiency Gains: By automating labor-intensive accounting functions, businesses can reduce operational costs, improve efficiency, and reallocate resources to revenue-generating activities. AI-powered accounting solutions optimize workflows, reducing the need for manual intervention and costly errors.

- Tax Compliance & Regulatory Adherence: AI helps businesses stay compliant with evolving tax regulations by automatically applying tax rules, generating accurate reports, and ensuring timely filings. This reduces the risk of penalties and streamlines tax preparation processes.

- Scalability & Business Growth: As businesses expand, financial complexity increases. AI-driven accounting systems are scalable, adapting to growing transaction volumes, multi-currency accounting, and regulatory requirements without adding operational strain.

- Strategic Decision-Making with Predictive Analytics: AI’s ability to forecast financial trends, predict cash flow fluctuations, and optimize budgeting helps businesses plan for the future with data-backed confidence. Predictive analytics improve long-term financial strategy and risk management.

Key Features of an AI-Powered Accounting Platform

An AI-powered accounting platform leverages artificial intelligence to automate financial processes, improve accuracy, and provide real-time insights. These platforms help businesses streamline accounting tasks while enhancing security and compliance.

- Automated Bookkeeping & Data Entry: AI eliminates manual data entry by automatically categorizing transactions, reconciling accounts, and updating financial records in real time. Machine learning algorithms improve accuracy by learning from past data, reducing human errors.

- Intelligent Invoice Processing: Using optical character recognition (OCR) and natural language processing (NLP), AI extracts key information from invoices and receipts, matches them with transactions, and processes payments efficiently. This reduces processing time and prevents duplicate payments.

- Real-Time Financial Reporting & Insights: AI-powered dashboards provide real-time updates on cash flow, expenses, revenue, and financial trends. Businesses can access instant insights to make data-driven decisions and improve financial planning.

- AI-Driven Fraud Detection: AI continuously monitors financial transactions to detect anomalies and suspicious activities. By analyzing historical data and identifying irregular patterns, AI helps businesses prevent fraud and comply with security regulations.

- Predictive Analytics & Financial Forecasting: AI-driven predictive models analyze past financial data to forecast revenue trends, cash flow fluctuations, and expense patterns. This feature allows businesses to plan, optimize budgets, and make proactive financial decisions.

- Tax Compliance & Regulatory Automation: AI ensures businesses stay compliant with tax laws, industry regulations, and financial reporting standards by automatically calculating tax liabilities, generating reports, and suggesting tax-saving opportunities.

- Smart Expense Management: AI-powered platforms automatically track and categorize expenses, flag unusual spending patterns, and suggest cost-saving measures. This feature simplifies expense tracking for businesses of all sizes.

- Virtual Assistants & Chatbots: AI-driven chatbots and virtual assistants help users with financial queries, generate reports, and provide accounting recommendations. These assistants improve workflow efficiency by offering instant support and guidance.

- Multi-Currency & Global Accounting Support: AI accounting systems support multi-currency transactions, real-time exchange rate tracking, and international tax regulations, making them ideal for global businesses.

- Seamless Integration with Financial Tools: An AI-powered accounting platform that integrates with bank accounts, payroll systems, e-commerce platforms, and ERP solutions to provide a unified financial management experience.

Key Benefits of AI-powered Accounting Platforms

AI-powered accounting platforms are revolutionizing financial management by automating processes, improving accuracy, and providing real-time insights. By leveraging machine learning (ML), natural language processing (NLP), and predictive analytics, these platforms help businesses optimize their accounting operations.

- Enhanced Accuracy & Error Reduction: AI minimizes human errors by automating data entry, transaction classification, and financial calculations. With machine learning algorithms continuously improving, the accuracy of financial records increases, reducing discrepancies and compliance risks.

- Automation of Repetitive Tasks: Routine accounting processes like invoice processing, reconciliation, and payroll management are automated, saving valuable time for finance teams. This allows businesses to focus on strategic decision-making rather than administrative tasks.

- Real-Time Financial Insights: AI-driven analytics provide businesses with real-time financial data, enabling them to monitor cash flow, revenue, expenses, and profitability instantly. This facilitates proactive financial management and decision-making.

- Fraud Detection & Risk Management: AI-powered platforms use advanced pattern recognition and anomaly detection to identify suspicious transactions and prevent fraud. This enhances financial security and ensures compliance with regulatory standards.

- Predictive Analytics for Better Decision-Making: AI forecasts financial trends, cash flow fluctuations, and revenue projections, allowing businesses to plan budgets more effectively. Predictive analytics help companies anticipate market changes and optimize financial strategies.

- Cost Savings & Operational Efficiency: By automating financial workflows, businesses reduce the need for manual labor, minimizing overhead costs. AI also ensures that financial tasks are completed faster and more accurately, improving overall efficiency.

- Improved Tax Compliance & Reporting: AI helps businesses stay compliant with tax laws, regulatory requirements, and financial reporting standards by automatically calculating tax liabilities, generating reports, and identifying potential tax deductions.

- Smart Expense & Budget Management: AI categorizes expenses, tracks spending patterns, and suggests cost-saving measures. This helps businesses optimize budgets, reduce unnecessary expenditures, and improve financial planning.

- Seamless Integration with Financial Systems: AI-powered accounting platforms integrate with banking systems, ERP solutions, payroll software, and e-commerce platforms, creating a unified financial ecosystem for businesses.

- Scalability for Growing Businesses: As businesses expand, AI-driven accounting solutions scale effortlessly, handling increased transaction volumes, multiple currencies, and global financial regulations without additional manual effort.

The Technology Stack for AI-Powered Accounting Software

Developing AI-powered accounting software requires a robust and scalable technology stack that integrates machine learning (ML), automation, cloud computing, and data security.

- Artificial Intelligence & Machine Learning: AI and ML form the core of AI-powered accounting software, enabling automated bookkeeping, intelligent data processing, fraud detection, and predictive analytics. These technologies help improve accuracy and decision-making capabilities over time.

- Natural Language Processing (NLP): NLP allows the software to understand, process, and analyze financial documents, invoices, and user queries. It powers chatbots, virtual assistants, and automated report generation, enhancing user experience and operational efficiency.

- Cloud Computing Infrastructure: A cloud-based infrastructure ensures scalability, accessibility, and security. It allows businesses to access accounting data in real time, collaborate remotely, and store large volumes of financial transactions securely.

- Big Data & Data Analytics: Big data technologies process and analyze vast amounts of financial data, providing real-time insights, anomaly detection, and business intelligence reports. This enables businesses to make informed financial decisions.

- Blockchain & Security Protocols: Security is critical in financial applications. Blockchain technology and advanced encryption methods ensure secure transactions, immutable records, and fraud prevention, maintaining trust and compliance in accounting processes.

- Robotic Process Automation (RPA): RPA automates repetitive financial tasks such as invoice processing, bank reconciliation, and expense categorization, significantly reducing human effort and improving operational efficiency.

- API Integrations: The software must integrate seamlessly with banking systems, tax authorities, payroll solutions, and enterprise resource planning (ERP) platforms through robust APIs, enabling smooth financial operations.

- Database Management Systems: A high-performance database is essential for storing, retrieving, and processing financial records efficiently. It ensures data consistency, fast query execution, and structured financial reporting.

- DevOps & Continuous Deployment: AI-powered accounting software requires an agile development approach with continuous updates, bug fixes, and security patches. DevOps practices ensure software reliability, efficiency, and real-time feature improvements.

- User Interface & Experience (UI/UX) Design: A user-friendly interface with an intuitive design enhances navigation, data visualization, and accessibility, allowing accountants and business owners to use AI-driven features with ease.

Steps to Develop an AI-Powered Accounting Platform

Developing an AI-powered accounting platform requires a structured approach, integrating automation, machine learning, and real-time financial processing.

- Define Objectives & Requirements

- Identify the core functionalities needed, such as automated bookkeeping, expense tracking, fraud detection, and predictive analytics.

- Determine the target audience, including small businesses, enterprises, or accounting firms.

- Establish compliance with financial regulations, tax laws, and data security standards.

- Choose the Right Technology Stack

- AI & Machine Learning: Power automation, pattern recognition, and predictive analytics.

- Natural Language Processing (NLP): Enable chatbots, report generation, and document processing.

- Cloud Infrastructure: Ensure scalability, data accessibility, and security.

- Robotic Process Automation (RPA): Automate repetitive financial tasks such as invoice processing and reconciliation.

- Blockchain & Security Measures: Implement encryption and fraud detection mechanisms for financial data integrity.

- Data Collection & Preprocessing

- Gather historical financial data from various sources like bank transactions, invoices, payroll, and tax filings.

- Clean, organize, and structure the data for AI models to learn and make accurate predictions.

- Use big data analytics to enhance financial insights and forecasting accuracy.

- Develop AI & Automation Modules

- Build AI-powered bookkeeping to categorize transactions and automate journal entries.

- Train machine learning models for predictive analytics, fraud detection, and risk assessment.

- Implement smart invoicing & expense management to track payments and flag anomalies.

- Develop AI chatbots & virtual assistants for real-time financial guidance.

- Build a Scalable & Secure Database

- Implement a high-performance database to manage real-time financial transactions.

- Ensure data encryption, multi-factor authentication, and role-based access controls for security.

- Integrate automated backup and disaster recovery mechanisms to prevent data loss.

- Develop API Integrations

- Connect the platform with banking systems, tax authorities, ERP solutions, and third-party accounting tools.

- Enable real-time data synchronization between different financial services.

- Ensure API compliance with regulatory standards like GAAP, IFRS, and GDPR.

- Design an Intuitive UI/UX

- Develop a user-friendly dashboard with real-time financial reports and analytics.

- Optimize navigation for accountants and business owners to access data easily.

- Provide customizable dashboards, financial insights, and interactive charts.

- Implement Testing & Quality Assurance

- Conduct unit, integration, and user acceptance testing (UAT) to ensure software reliability.

- Test AI models for accuracy in transaction categorization, anomaly detection, and tax calculations.

- Identify security vulnerabilities through penetration testing and compliance checks.

- Deploy & Optimize the Platform

- Launch the platform on cloud servers for seamless access and scalability.

- Monitor AI performance and continuously refine algorithms based on user feedback.

- Ensure regular updates for security patches, feature enhancements, and compliance adjustments.

- Provide Continuous Support & Maintenance

- Offer 24/7 customer support, AI troubleshooting, and system monitoring.

- Upgrade AI models to improve financial insights and adapt to evolving tax regulations.

- Gather user feedback to enhance platform usability and introduce new features.

Benefits of AI in Accounting

Artificial Intelligence (AI) is transforming accounting by enhancing accuracy, efficiency, and decision-making. Businesses leveraging AI in accounting gain significant advantages in automation, compliance, and financial insights.

- Increased Accuracy & Error Reduction: AI minimizes human errors by automating complex calculations, data entry, and financial reconciliations, ensuring more reliable financial records.

- Automation of Repetitive Tasks: AI streamlines time-consuming processes such as transaction categorization, payroll processing, and invoice management, allowing accountants to focus on strategic tasks.

- Real-Time Financial Insights: With AI-powered analytics, businesses gain real-time visibility into cash flow, expenses, and profitability, enabling faster and more informed financial decisions.

- Enhanced Fraud Detection & Risk Management: AI detects unusual patterns in financial data, identifying potential fraud or inconsistencies, helping businesses mitigate financial risks and ensure regulatory compliance.

- Cost Savings & Operational Efficiency: By reducing manual workloads and automating financial tasks, AI lowers operational costs while improving efficiency in financial management.

- Predictive Analytics for Better Decision-Making: AI-driven forecasting helps businesses anticipate financial trends, optimize budget planning, and improve overall financial strategy.

- Improved Compliance & Regulatory Adherence: AI ensures adherence to tax laws, financial regulations, and reporting standards by automating compliance checks and generating accurate financial reports.

- Scalable & Adaptive Financial Management: AI-powered accounting systems can easily scale with business growth, handling increased transactions, multiple currencies, and evolving financial regulations.

- Seamless Integration with Financial Systems: AI enables smooth integration with banking systems, ERP platforms, and tax authorities, ensuring synchronized financial data across multiple sources.

- Enhanced Decision-Making with AI-driven Insights: AI processes large volumes of financial data quickly, providing data-driven recommendations that help businesses optimize resource allocation and financial planning.

Use Cases of AI in Accounting

AI is revolutionizing the accounting industry by automating processes, enhancing accuracy, and providing real-time financial insights.

- Automated Bookkeeping: AI automates data entry, transaction categorization, and financial reconciliations, eliminating the need for manual bookkeeping and reducing errors.

- Smart Invoice Processing: AI extracts data from invoices, matches them with purchase orders, and automates approvals, ensuring faster and more efficient accounts payable management.

- Fraud Detection & Risk Assessment: AI analyzes financial transactions to detect anomalies, flag suspicious activities, and mitigate financial risks, enhancing security and compliance.

- Predictive Financial Forecasting: AI-powered analytics help businesses predict cash flow, revenue trends, and financial risks, enabling better budget planning and strategic decision-making.

- Real-Time Tax Compliance: AI ensures tax accuracy by automating calculations, tracking regulatory changes, and generating compliance-ready financial reports.

- Payroll Automation: AI streamlines payroll processing by calculating salaries, deductions, and tax withholdings while ensuring compliance with labor laws and tax regulations.

- AI-Powered Virtual Assistants: AI chatbots and virtual assistants provide real-time financial insights, answer accounting queries, and assist with tax and expense management.

- Expense Management Optimization: AI analyzes spending patterns, categorizes expenses, and provides insights to optimize cost management and reduce unnecessary expenditures.

- Audit Process Enhancement: AI automates audit trails, detects inconsistencies in financial records, and speeds up the auditing process with high accuracy.

- Seamless Integration with Financial Systems: AI enables integration between accounting software, banking systems, ERP platforms, and tax authorities for real-time financial data synchronization.

Real-world Examples of AI in Accounting

AI is transforming the accounting industry by automating processes, reducing errors, and providing advanced financial insights.

- QuickBooks – AI-Powered Expense Categorization

QuickBooks uses AI to automatically categorize expenses, track financial transactions, and generate real-time financial reports, reducing manual bookkeeping efforts.

- Xero – Automated Bank Reconciliation

Xero leverages AI to match bank transactions with invoices and expenses, streamlining bank reconciliation and ensuring financial accuracy.

- Sage Intacct – AI-Based Financial Forecasting

Sage Intacct uses AI-driven predictive analytics to help businesses forecast cash flow, revenue, and expenses, improving financial planning.

- Botkeeper – AI-Powered Virtual Accounting Assistant

Botkeeper automates bookkeeping tasks such as transaction categorization, reconciliation, and financial reporting using AI and machine learning.

- BlackLine – AI-Driven Financial Close Automation

BlackLine automates the financial closing process by analyzing transactions, detecting anomalies, and ensuring compliance with accounting standards.

- Workday Adaptive Planning – AI for Budgeting & Forecasting

Workday’s AI-powered platform helps businesses create accurate financial models, optimize budgeting, and improve long-term financial planning.

- Deloitte’s AI Audit Tool – Fraud Detection & Risk Assessment

Deloitte utilizes AI in audit services to detect fraudulent transactions, analyze financial patterns, and ensure regulatory compliance.

- PWC's GL.ai – AI-Powered General Ledger Analysis

PwC’s AI tool, GL.ai, scans financial transactions, detects irregularities, and enhances audit accuracy by analyzing large volumes of financial data.

- OneUp – Automated Bookkeeping & Bank Synchronization

OneUp uses AI to automate bookkeeping by syncing bank transactions, categorizing expenses, and reconciling accounts in real time.

- UiPath – AI-Powered Robotic Process Automation (RPA) in Accounting

UiPath integrates AI and RPA to automate repetitive accounting tasks such as invoice processing, payroll management, and tax compliance.

Future Trends in AI Accounting

AI is rapidly transforming the accounting industry, and its future will be shaped by innovations that enhance automation, accuracy, compliance, and financial decision-making.

- Hyperautomation in Accounting: AI and Robotic Process Automation (RPA) will work together to automate complex accounting workflows, including audits, reconciliations, tax filings, and financial reporting, reducing human intervention.

- AI-Driven Predictive Analytics for Financial Planning: AI will enable real-time financial forecasting, budgeting, and risk assessment, helping businesses anticipate cash flow trends, optimize expenses, and make data-driven decisions.

- Advanced AI Chatbots & Virtual CFO Assistants: AI-powered chatbots and virtual assistants will handle queries, financial insights, invoice processing, and compliance checks, making accounting more interactive and user-friendly.

- AI-Powered Fraud Detection & Risk Management: Machine learning models will enhance fraud detection by identifying anomalous transactions, suspicious activities, and compliance violations, ensuring greater financial security.

- Real-Time Compliance & Regulatory Adaptation: AI will automatically track changing tax laws, accounting standards (GAAP, IFRS), and compliance regulations, ensuring businesses stay updated with financial reporting requirements.

- Blockchain Integration for Transparent & Secure Accounting: AI and blockchain will work together to create tamper-proof, decentralized financial records, improving transparency, security, and trust in accounting systems.

- AI-Powered Tax Automation: AI-driven tax tools will automate tax calculations, optimize deductions, and reduce filing errors, streamlining corporate tax management.

- Personalized Financial Insights Using AI & Big Data: AI will analyze financial behaviors to offer customized financial strategies, investment recommendations, and cost-saving insights for businesses and individuals.

- AI-Generated Financial Reports & Smart Decision-Making: AI will autonomously generate financial statements, analyze balance sheets, and provide strategic recommendations for businesses.

- Enhanced AI Integration with ERP & Accounting Software: AI will seamlessly integrate with ERP systems, banking platforms, and financial software, enabling real-time data synchronization and financial automation.

Why Should Businesses Invest in AI-powered Financial Solutions?

As financial management becomes increasingly complex, businesses must adopt AI-powered financial solutions to stay competitive, improve efficiency, and enhance decision-making.

- Improved Accuracy & Error Reduction: AI minimizes human errors in data entry, bookkeeping, tax calculations, and financial reporting, ensuring more precise financial records and reducing costly mistakes.

- Automation of Repetitive Tasks: AI automates time-consuming tasks like invoice processing, payroll management, reconciliations, and tax filings, allowing finance teams to focus on strategic initiatives.

- Real-Time Financial Insights & Decision-Making: AI-powered analytics provide instant access to financial data, trends, and forecasts, helping businesses make data-driven decisions and optimize cash flow management.

- Cost Efficiency & Resource Optimization: By reducing manual workloads and increasing operational efficiency, AI-driven solutions lower accounting costs, labor expenses, and compliance-related penalties.

- Enhanced Fraud Detection & Security: AI-powered algorithms detect anomalous transactions, unauthorized access, and fraudulent activities, strengthening financial security and reducing risks.

- Predictive Analytics for Future Planning: AI enables businesses to anticipate financial trends, cash flow fluctuations, and market risks, allowing them to proactively adjust budgets and investment strategies.

- Compliance & Regulatory Adherence: AI ensures businesses stay compliant by automating tax calculations, tracking regulatory changes, and generating audit-ready reports, reducing legal risks.

- Scalability & Business Growth: AI-powered financial solutions are scalable, meaning businesses can easily handle increasing transactions, global operations, and financial complexities without increasing costs.

- AI-Integrated Financial Ecosystem: AI seamlessly integrates with ERP systems, banking platforms, and accounting software, ensuring real-time financial data synchronization and reducing inefficiencies.

- Competitive Advantage & Future Readiness: Businesses investing in AI-powered financial solutions gain a technological edge, improved financial agility, and long-term sustainability, positioning themselves for future growth.

Why Choose INORU for AI-Powered Accounting Platform Development?

INORU is a leading provider of custom AI-powered accounting solutions, helping businesses automate financial processes, enhance decision-making, and ensure compliance with cutting-edge AI technologies.

- Expertise in AI & Financial Technology: INORU specializes in AI, machine learning, and financial software development, ensuring that your accounting platform is built with the latest technological advancements.

- Customizable & Scalable Solutions: Whether you need an enterprise-level AI accounting solution or a startup-friendly financial management tool, INORU offers fully customizable and scalable platforms tailored to your business needs.

- Advanced Automation & AI Capabilities: INORU integrates AI-powered features such as automated bookkeeping, real-time financial analytics, predictive forecasting, and fraud detection, streamlining your accounting operations.

- Compliance & Regulatory Adherence: INORU ensures that its AI-powered accounting solutions comply with global financial regulations (GAAP, IFRS, GDPR, etc.), tax laws, and industry standards, reducing legal risks.

- Seamless Integration with Financial Systems: INORU develops accounting platforms that integrate seamlessly with ERP software, banking systems, payment gateways, and other financial tools, ensuring a connected financial ecosystem.

- Secure & Reliable AI Infrastructure: With robust data encryption, multi-layer security protocols, and fraud detection systems, INORU provides highly secure AI accounting platforms, protecting sensitive financial data.

- Real-Time Insights & Predictive Analytics: INORU’s AI-powered solutions provide real-time financial reports, automated reconciliations, and predictive analytics, helping businesses make data-driven financial decisions.

- 24/7 Support & Maintenance: INORU offers dedicated customer support, regular software updates, and ongoing maintenance, ensuring your accounting platform operates smoothly at all times.

- Cost-Effective Development Services: INORU provides budget-friendly AI accounting solutions without compromising on quality, making AI-powered financial management accessible to businesses of all sizes.

- Proven Track Record & Client Satisfaction: With years of experience in AI-driven software development, INORU has successfully delivered high-performance accounting solutions to enterprises worldwide.

Conclusion

The evolution of accounting through AI Development Solutions is transforming financial management by enhancing accuracy, automating repetitive tasks, and providing real-time insights. Businesses that integrate AI-powered accounting platforms benefit from streamlined operations, improved compliance, and advanced fraud detection. With AI-driven predictive analytics and automation, companies can make more informed financial decisions, optimize resources, and maintain a competitive edge in a fast-paced digital economy.

As AI continues to revolutionize accounting, adopting an AI-powered accounting platform is no longer an option but a necessity for businesses aiming for efficiency and scalability. From automated bookkeeping to intelligent financial forecasting, AI solutions reduce manual workloads while increasing transparency and accuracy. A well-developed AI-driven accounting system ensures seamless integration with financial tools, regulatory compliance, and cost-effective financial management, making it an invaluable asset for modern businesses.