Our All-in-One

Crypto Perpetual Exchange Development Services

Explore the wide range of Perp DEX Platform Development services we offer, designed to help you map your platform’s structure, build its core features, and launch confidently in the DeFi.

Platform Architecture Design

We design the full architectural structure of your perpetual DEX, defining trading modules, data connections, feature layout, and system flow for a clear development direction.

Perpetual Smart Contracts

Our team builds the smart contracts that run trading, covering position logic, margin rules, funding flow, and liquidation behavior to support reliable on-chain operations.

Core Trading Engine

We develop the core trading engine that powers perpetual markets, handling position actions, leverage effects, and P&L tracking to maintain consistent platform performance.

Price Oracle Integration

Our experts connect your DEX to trusted price oracles, delivering accurate asset data and dependable updates that support fair valuations and stable perpetual trading functions.

Margin & Liquidation Logic

We create the margin and liquidation logic that manages collateral, funding impact, and safety thresholds, giving your perpetual DEX a stable and predictable risk framework.

Liquidity Pool Architecture

Our liquidity design supports active markets through structured pools, routing paths, and asset flow logic that help maintain steady trading activity on your perpetual DEX.

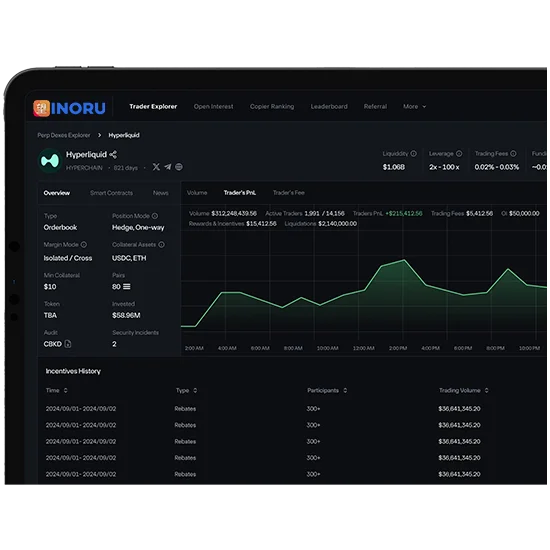

Trader Dashboard Design

We design a user-friendly trading dashboard that displays positions, pricing, margin details, and controls, giving traders a clear and organized interface for daily platform use.

Quality Assurance Framework

Our QA framework tests contract logic, trading behavior, and performance factors, ensuring your perpetual DEX meets stability standards before moving into final deployment stages.